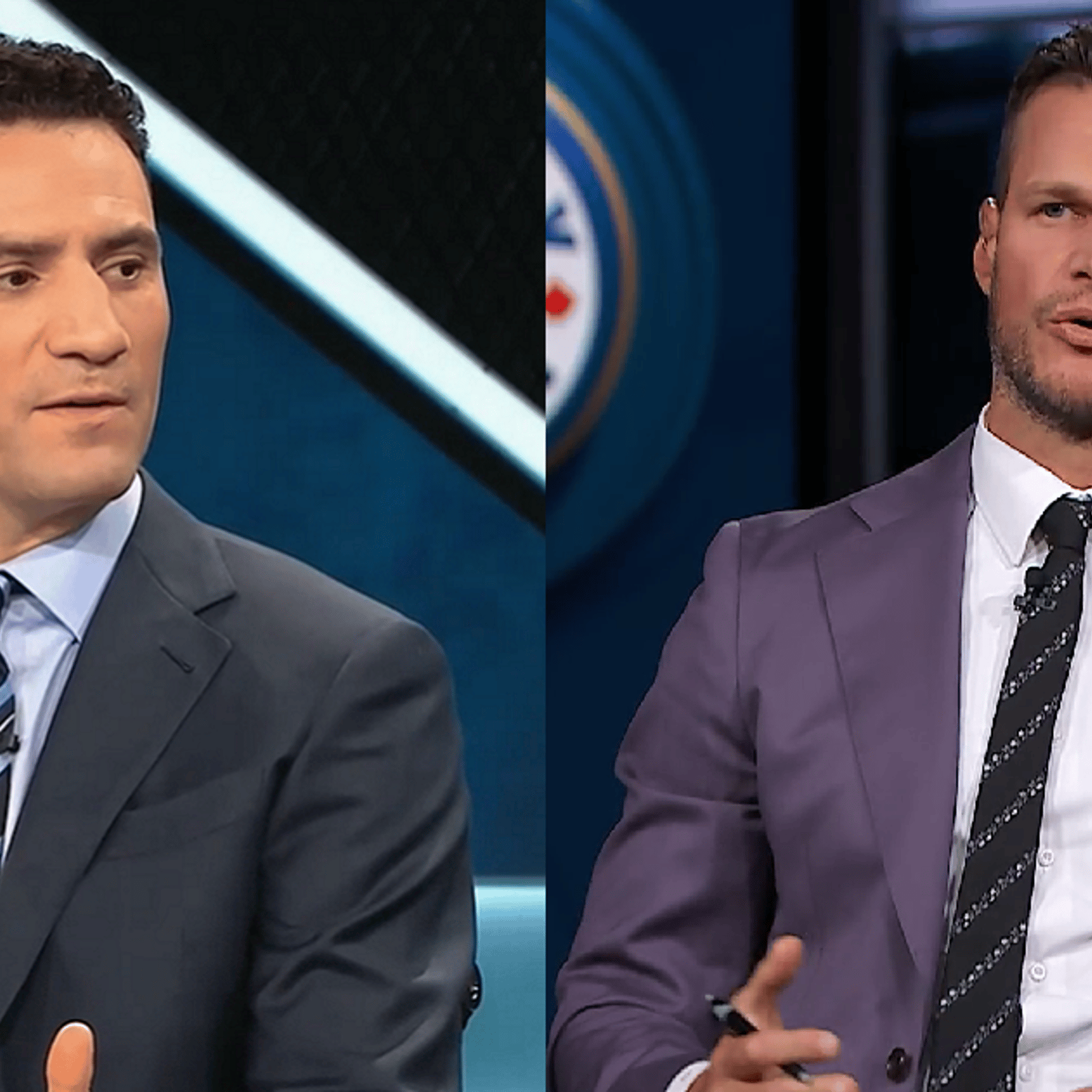

Former Leafs Tucker and Corson under investigation for “tax scam” in Canada

Uh oh. This could be ugly.

HockeyFeed

Jesse McLean of The Toronto Sun is reporting that former Toronto Maple Leafs players Darcy Tucker and Shayne Corson are under investigation by the Canada Revenue Agency (CRA) for what the CRA alleges is a "sham" to skirt paying taxes.

Check it out:

McLean goes on to explain the nature of the allegations against both Tucker and Corson and, suffice it to say, that these are some pretty serious allegations that could cost the former NHLers millions in back taxes. I'm no tax expert, but I'll do my best to explain exactly what Tucker and Corson are accused of doing. During their playing days with the Leafs both Tucker and Corson reportedly invested in foreign currency. Meaning essentially that they bought foreign money with the hopes that they would increase in value. Initially though, the pair reported millions of dollars in losses that the CRA alleges are not real. Instead, the CRA maintains that those losses were part of a "sham" to claim reduced taxable income. Of course, they would then have a money manager produce gains with the investments when their NHL careers were over and the players would get a more favourable tax rate.

In effect, they hide their millions away until they were done playing so that they'd pay less in taxes.

Call me crazy... but that sounds like a pretty effective money management plan. Again, I'm not a tax expert and I'm by no means wealthy, but I know a little bit about capital gains and losses.

In any case, both Tucker and Corson have denied the CRA's allegations in court and maintain that any investments they made during their playing days or during retirement were done legitimately and that gains were reported as income and taxed accordingly. In other words: We already paid you. Leave us alone. The problem though seems to be the method in which the players used to limit their tax liabilities, meaning the buying and selling of foreign currency. The CRA alleges that more than 150 Canadians have used this exact scheme totalling tax losses of roughly $215 million over a seven year period.

- Jonathan Larivee

Terrible news from Evander Kane just before Game 1.

- NHL News

- 2 minutes read

- Jonathan Larivee

Refs intervene over questionable act from Leafs after Game 1.

- NHL News

- 2 minutes read

- Jonathan Larivee

Bieksa, Bissonnette call out 2 Maple Leafs after a brutal Game 1.

- NHL News

- 3 minutes read

- Jonathan Larivee

Sheldon Keefe calls out Max Domi over Game 1 performance.

- NHL News

- 2 minutes read

- Jonathan Larivee

Seth Jones' comments rub fans in Chicago the wrong way.

- NHL News

- 3 minutes read